Mesothelioma and Asbestos Trust Funds

Asbestos trust funds were established to provide financial compensation for individuals harmed by asbestos exposure. For individuals facing the costs of mesothelioma treatment or loss of income, these funds are available to ensure that victims and their families continue to have access to compensation, even when the responsible companies have gone out of business.

Home » Nationwide Mesothelioma Lawyers » Asbestos Trust Funds

- Content last modified:

Navigate this page

Asbestos Trust Fund Quick Facts

- As of 2025, asbestos trust funds hold more than $30 billion in total assets.

- Over 60 active trusts currently provide compensation to asbestos victims across the nation.

- The average mesothelioma trust fund payout ranges from $100,000 to $300,000.

- Payment percentages vary by trust, typically ranging from 10 percent to 30 percent of the claim value.

- Family members may qualify for wrongful death compensation through these funds.

What Are Mesothelioma Trust Funds?

Asbestos trust funds are financial reserves established by companies that manufactured or used asbestos-containing products. When many of these companies filed for bankruptcy, courts required them to set aside money in trusts. The purpose was simple—to ensure that people injured by their products could still receive compensation for illnesses like mesothelioma, asbestosis, and other asbestos-related diseases.

These funds enable victims to access compensation without the need to file a traditional lawsuit against companies that no longer exist. Instead of going through a lengthy court process, a person can file a claim directly with the trust. If the claim meets the criteria set by that trust, compensation is awarded based on the level of illness and the claimant’s exposure history.

Today, dozens of asbestos trust funds remain active. Many of them were established by some of the largest asbestos product manufacturers in history, including Johns Manville, Owens-Corning, and W.R. Grace. Together, these trusts still hold billions of dollars designated for asbestos victims and their families.

Contact Us Today

Get your free case review 24 hours a day.

Fields marked with an * are required

Who Is Eligible To File an Asbestos Trust Fund Claim?

Eligibility for an asbestos trust fund claim depends on several factors; however, the main requirement is proof of asbestos exposure linked to a company with an active trust. A person must show that their exposure to that company’s products directly contributed to their diagnosis. Typically, a claimant must provide medical records confirming a qualifying asbestos-related disease, such as mesothelioma, and evidence of employment or product exposure tied to that company.

Each trust fund sets its own criteria. Some may focus on specific job sites or product types, while others require evidence from specific time periods. Eligibility can also vary based on the claimant’s diagnosis date and the state where exposure occurred.

It’s common for claimants to qualify for multiple trusts. Many people were exposed to asbestos through products made by several different companies. An experienced mesothelioma lawyer can review work and medical history to identify which trusts apply and handle each claim accordingly.

Family Members

Family members may also qualify to file an asbestos trust fund claim if a loved one has passed away due to an asbestos-related illness. In these cases, surviving spouses, children, or dependents may be able to pursue compensation through what’s called a “wrongful death” claim. The funds can help cover medical expenses, lost income, and funeral costs. Every trust handles these situations differently, but many allow families to receive the same types of payments that the victim would have been entitled to if they were still living.

Mesothelioma Trust Fund Payouts in 2025

Asbestos trust funds continue to be a financial lifeline for victims of exposure in 2025. To date, mesothelioma trust funds have distributed billions of dollars to claimants across the United States. The total amount available fluctuates as claims are paid and funds are replenished with interest or investment returns.

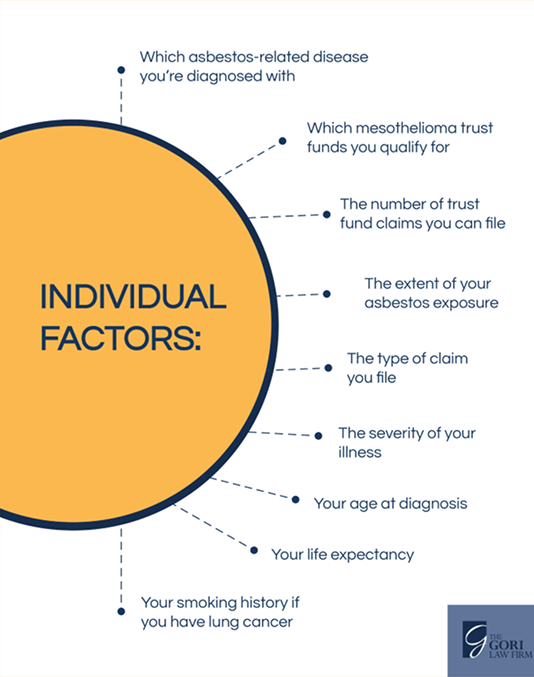

According to industry analyses from sources like RAND and KCIC, individual payouts will vary, based on factors such as the trust’s payment percentage, the severity of illness, and exposure history, but while some claims result in tens of thousands of dollars, others reach several hundred thousand, depending on eligibility and the quality of documentation.

How Much Money Is Left in Asbestos Trust Funds?

Asbestos trust funds were designed to last for decades, ensuring that both current and future victims can receive compensation. Analysts estimate that approximately $30 billion remains available across all active asbestos trust funds. Some of the most significant funds—including those tied to Owens Corning, United States Gypsum, and Armstrong World Industries—continue to distribute payments to qualifying claimants every year.

How Do Trust Fund Payment Percentages Work?

Each trust fund offers a payment percentage of a claim’s value to maintain long-term stability and help allocate monies to people in the projected future. If a trust initially valued a mesothelioma claim at $200,000 but operates at a 25 percent payment percentage, the claimant would receive $50,000. This system helps ensure that the trust can compensate both current and future claimants fairly, based on projected claim volumes and fund resources.

These percentages are periodically reviewed and adjusted by the trustees who manage each fund. Claimants who file early and meet the criteria often receive payment within a few months after approval, making the process significantly faster than traditional litigation.

Mesothelioma Claim Values vs. Payouts in Selected Trusts

Name of Trust

Manville Trust

Bondex Trust

C.E. Thurston

Raytech

Scheduled Value

$350,000

$80,000

$25,000

$125,000

Percentage Paid

5.1%

22%

35%

0.92%

Payout

$17,850

$17,600

$8,750

$1,150

List of Asbestos Trust Funds

There are more than 60 active asbestos trust funds in the United States. Each was established by a company that once manufactured or sold asbestos-containing products. Examples include:

- Johns Manville Personal Injury Settlement Trust

- Owens Corning/Fibreboard Asbestos Personal Injury Trust

- Armstrong World Industries Asbestos Personal Injury Settlement Trust

- United States Gypsum Asbestos Personal Injury Settlement Trust

- Babcock & Wilcox Company Asbestos Personal Injury Settlement Trust

A complete list of active asbestos trust funds is available through The Gori Law Firm’s list of asbestos trusts. These funds cover industries ranging from construction and shipbuilding to automotive manufacturing and insulation production. Each trust manages its own claim procedures, filing requirements, and compensation schedules.

A & I Company Trust

A-Best Trust

A.P.I Asbestos Trust

ABB Lummus Trust

Armstrong World Industries Trust

Asarco, LLC Trust

Brauer Supply Trust

Burns & Roe Trust

C.E. Thurston Trust

Christy Refractories Trust

EJ Bartels Asbestos Settlement Trust

Ferodo Trust

Flexitallic Trust

Fuller Austin Insulation Inc Trust

General Motors Corporation

GI Holdings Trust

Halliburton Company Trust

Hercules Chemical Company Trust

J.T. Thorpe Settlement Trust

J.T. Thorpe Company

Kentile Floors, Inc.

Leslie Trust

North American Refractories Trust

Pacor Trust

Phillip Carey Manufacturing Trust

Plant Insulation Trust

Porter Hayden Trust

Rapid American

Raytech Trust

Shook & Fletcher Trust

T & N Limpet Trust

THAN – TH Agriculture and Nutrition Trust

Thorpe Insulation Company Trust

U.S. Mineral Products Company Trust

UGL Trust

Western Asbestos Trust

Worthington Pump and Machinery Trust

Yarway Bankruptcy Trust

How to File an Asbestos Trust Claim

Filing a claim with an asbestos trust fund involves several steps. While the process can seem detailed, an experienced attorney can handle most of the steps on behalf of the claimant.

The Gori Law Firm’s infographic on the claim process provides a clear visual guide.

Step 1: Meet Trust Fund Criteria

Each asbestos trust fund has its own set of criteria for eligibility. This typically includes: Medical documentation of a qualifying illness, a detailed history of asbestos exposure, and evidence linking that exposure to the company’s products.

Step 2: Collect Evidence to Support Your Claim

Strong claims rely on a strong collection of evidence: documents such as medical records, pathology reports, employment histories, and affidavits from coworkers. The more comprehensive the body of evidence, the stronger the claim will be.

Step 3: Submit Your Claim

After gathering all required materials, the claim is then filed with the trust. Attorneys will ensure the claim meets all requirements by reviewing the claim form and all supporting evidence, thereby reducing the risk of any delays or potential rejection.

Step 4: Claim Reviewed for Approval

Once submitted, the trust reviews the claim for accuracy and completeness. If approved, payment is issued based on the trust’s established payout schedule. Many claims are resolved in a matter of months, providing vital relief for victims and their families.

How Do Mesothelioma Trust Fund Claims Compare to Other Mesothelioma Claims?

Unlike personal injury, product liability, or wrongful death lawsuits, mesothelioma trust fund claims differ in that they allow victims to receive compensation even when the responsible companies have gone bankrupt. Additionally, trust funds are typically faster, less complex, and don’t require a court trial.

Lawsuits, however, may offer higher potential awards, particularly when multiple parties are liable. In some cases, claimants pursue both—filing trust fund claims while also pursuing active lawsuits against solvent companies. This combined approach can help ensure victims receive the maximum compensation available for their diagnosis.

Common Questions About Asbestos Trust Funds

What Are the Pros and Cons of Filing an Asbestos Trust Fund Claim Versus a Lawsuit?

Trust fund claims are generally more efficient and predictable. They avoid lengthy court battles and provide access to money sooner. Lawsuits can take years and carry more uncertainty, though they may result in higher payouts. Many victims choose to pursue both options with the guidance of a lawyer to ensure they receive full compensation.

Is Asbestos Trust Fund Compensation Taxable?

Compensation from asbestos trust funds is typically not taxable under federal law when it covers personal injuries or illnesses. However, certain portions related to punitive damages or lost wages could be subject to taxation. Legal counsel can help clarify how specific awards apply to each individual situation.

How Much Is the Average Trust Fund Claim Payout?

The average asbestos trust fund payout for mesothelioma claims often ranges from $100,000 to $300,000. Some claims result in smaller payments, while others exceed this range, depending on the fund, payment percentage, and the claimant’s medical and exposure evidence.

Can a Family Member File an Asbestos Trust Fund Claim?

Yes. Many trust funds recognize the financial and emotional losses families face and allow claims for wrongful death compensation. If a loved one has passed away from mesothelioma or another asbestos-related disease, a surviving family member can file on their behalf.

Don't Wait, Access Mesothelioma Settlement Funds Now

Time limits apply to filing asbestos-related claims. Delays can impact eligibility, especially if the statute of limitations expires. Acting promptly can preserve your right to receive compensation and provide much-needed financial support for treatment and recovery.

Act now to protect your rights. File your mesothelioma claim today by contacting The Gori Law Firm or calling 618-659-9833 for a free case review. Immediate help is available to guide you through the process and ensure your claim progresses smoothly.

“I just wanted to thank you for helping me through this process. Your compassion and professionalism meant the world to me.”

— Trust Fund Client