Asbestos Trust Fund Payouts for Mesothelioma Victims

Mesothelioma trust funds are money that asbestos product manufacturers set aside during bankruptcy proceedings for the benefit of asbestos exposure victims. If you have been diagnosed with an asbestos-related illness and one of these companies is responsible for your exposure to asbestos, our award-winning mesothelioma lawyers to guide you through the process and recover the maximum payout available.

Home » Nationwide Mesothelioma Lawyers » Asbestos Trust Funds

- Content last modified:

- An asbestos trust fund is money that has been set aside by bankrupt manufacturers of asbestos-containing products.

- You must file a separate asbestos trust fund claim against each company responsible for your asbestos exposure.

- Family members of deceased asbestos victims can also file claims.

- Approximately $30 billion is available in the asbestos and mesothelioma trust funds.

- Our experienced mesothelioma lawyers at The Gori Law Firm can identify the trust funds available for your asbestos exposure.

Navigate this page

- What Are Asbestos Trust Funds?

- How Much Money Is Left In Asbestos Trusts?

- Who Can File Mesothelioma Fund Claims?

- Average Asbestos Trust Fund Payouts in 2024

- How to File an Asbestos Trust Claim

- Asbestos Trust Fund Claim Payout Timeline

- Asbestos Claim Compensation Options

- Over $4 Billion Recovered for Asbestos Victims Nationwide

- Don’t Wait, Access Mesothelioma Settlement Funds Now

- View Our List of Asbestos Trust Funds

- Asbestos & Mesothelioma Fund Claims FAQs

What Are Asbestos Trust Funds?

Asbestos trust funds contain money that bankrupt asbestos product manufacturers set aside for the benefit of the people they have exposed to asbestos who later develop asbestos-related illnesses. Each company establishes a separate fund. An administrator reviews claims and pays out compensation.

Many companies declared bankruptcy in response to the large number of lawsuits asbestos exposure victims filed against them. Bankruptcy can help businesses avoid the full burden of their liabilities. However, the U.S. Bankruptcy Code requires bankrupt companies with asbestos liabilities to establish trust funds to compensate exposure victims.

Without the asbestos and mesothelioma trust funds, asbestos victims would be denied compensation for medical bills, pain and suffering, and lost wages from the companies that knowingly exposed them to harmful asbestos products.

Contact Us Today

Get your free case review 24 hours a day.

Fields marked with an * are required

How Much Money Is Left In Asbestos Trusts?

Approximately $30 billion is left in the trust funds as of 2024. More than 60 companies have filed for bankruptcy and established asbestos and mesothelioma trust funds. From 1988 to 2010, approximately 3.3 million asbestos exposure victims filed claims against the asbestos trust funds, totaling $17.5 billion in payouts.

Contact Us Today for a Free Mesothelioma Case Review.

Who Can File Mesothelioma Fund Claims?

You may be eligible to file a mesothelioma trust fund claim if you have been diagnosed with an asbestos-related illness, a bankrupt company is responsible for your asbestos exposure, and you are one of the following:

- A patient diagnosed with an asbestos-related disease

- The family member of someone who died from an asbestos-related disease

- The estate representative of a deceased asbestos exposure victim

If you fall into one of these categories, contact our mesothelioma law firm right away. We can identify all of the mesothelioma trust funds that owe you compensation, help you file your claims, and ensure you receive the funds you deserve.

Average Asbestos Trust Fund Payouts in 2025

Trust fund payouts can range from a few thousand dollars to hundreds of thousands. Every trust fund pays compensation according to the funds available, the number of claims, and the values established in Trust Distribution Procedures. Many funds offer an expedited claims process, which yields a fixed value.

Asbestos and mesothelioma trust funds have received more claims than anticipated. In an effort to avoid running out of funds before all asbestos victims have had a chance to recover compensation, many of the trust funds have reduced the percentages they pay. The table below shows examples of scheduled claim values and resulting payouts after the reduced payment percentage is applied.

Mesothelioma Claim Values vs. Payouts in Selected Trusts

| Name of Trust | Scheduled Value | Percentage Paid | Payout |

| Manville Trust | $350,000 | 5.1% | $17,850 |

| Bondex Trust | $80,000 | 22% | $17,600 |

| C.E. Thurston | $25,000 | 35% | $8,750 |

| Raytech | $125,000 | 0.92% | $1,150 |

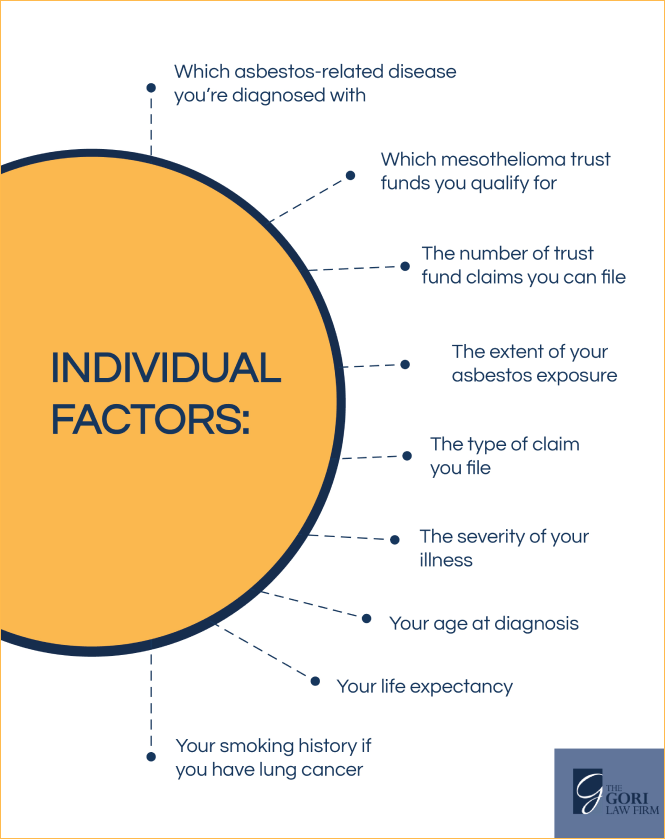

You do not have to accept the scheduled value. You can opt for an individual review, which could yield a higher trust fund payout. Though it is common for an individual review to yield higher compensation, there is also a risk that your payout could be lower. The amount you receive will depend on individual factors, including:

“Manville: MV Trust pro Rata Increase.” Claimsres, 18 Feb. 2021,

Claimsres, 18 Feb. 2021, www.claimsres.com/2021/02/18/manville-mv-trust-pro-rata-increase/. Accessed 19 Jan. 2024.

“Bondex Trust FAQs - Bondex Trust | Claims Processing Facility Inc.”

Www.cpf-Inc.com, www.cpf-inc.com/trusts/bondex-trust/bondex-trust-faqs/. Accessed 19 Jan. 2024.

“C.E. Thurston – Page 2.”

Claimsres, 17 Apr. 2018, www.claimsres.com/category/c-e-thurston/page/2/. Accessed 19 Jan. 2024.

https://www.cpf-inc.com/assets/1/6/RAY_Trust_Payment_Percentage_Notice_2018.pdf

- Which asbestos-related disease you’re diagnosed with

- Which mesothelioma trust funds you qualify for

- The number of trust fund claims you can file

- The extent of your asbestos exposure

- The type of claim you file

- The severity of your illness

- Your age at diagnosis

- Your life expectancy

- Your smoking history if you have lung cancer

A qualified mesothelioma lawyer can identify all of the trust fund claims you are eligible to file and determine whether an expedited or individual claim is best for you. When you work with the nationally recognized mesothelioma lawyers at The Gori Law Firm, you can rest assured that they have the skills and experience needed to handle your claim.

How to File an Asbestos Trust Claim

The first step in filing an asbestos trust fund claim is contacting a reputable asbestos exposure attorney. Our attorneys at Gori Law are ready to help you secure your trust fund payout as soon as possible. We will handle every step of the process and aggressively pursue every available avenue toward compensation.

When we file your trust fund claim, we will:

- Investigate your asbestos exposure to identify all of the companies that exposed you to asbestos and determine which mesothelioma trust funds apply to your case.

- Gather evidence to prove that the companies are responsible for your asbestos exposure.

- Gather the medical records needed to confirm your diagnosis of an asbestos-related illness.

- Evaluate the evidence and determine whether you should pursue higher compensation amounts than those awarded in the expedited claims.

- Once your claim is approved, we will collect the funds and distribute them to you.

Asbestos Trust Fund Claim Payout Timeline

The time it takes to recover your compensation will depend on the number of claims the fund has received and the type of claim you file. Some trust fund claims can be processed within a few weeks, especially if they are expedited. If you submit your claim for individual review, it will require more time.

Either way, the processing time for your asbestos trust fund claim is generally shorter than the time it takes to recover compensation in a mesothelioma lawsuit.

The sooner you file your asbestos trust fund claim, the sooner you can receive compensation. It is important not to put off your claim because trust funds limit the amount of time you have to file a claim. Most trust funds use the same timeline provided by your state’s statute of limitations.

You could recover hundreds of thousands from asbestos trust funds, but if you wait too long, you could lose out. Contact our skilled mesothelioma attorneys today to start your claim.

“I just wanted to send a thank you to everyone at the Firm. We received our first ever Trust Settlement check and it served as a little glimmer of hope, and it helped my other family members realize that this is genuinely happening. Some were believing that what is going on isn’t real or genuine. This helped stoke belief. For myself, I have always believed in you and will continue to be your cheerleader and I thank you from the bottom of my heart for the hard work you are all doing.“

– J.R – Asbestos Trust Fund Client

Asbestos Claim Compensation Options

When you choose Gori Law, you can count on us to pursue the maximum compensation available, which can be significant in asbestos exposure cases. In addition to filing your asbestos trust fund claims, we will look for other sources of compensation so you can receive every penny you deserve.

You may be able to recover significant damages through the following, in addition to your trust fund claims:

Over $4 Billion Recovered for Asbestos Victims Nationwide

Mesothelioma

Age 73 – Deceased – Insulator

Mesothelioma

Age 76 – Deceased – Carpenter

Mesothelioma

Age 70 – Deceased – Carpenter

Mesothelioma

Age 58 – Deceased – Glass Worker

Mesothelioma

Age 67 – Deceased – Spouse – Inspector

Mesothelioma

Age 59 – Living – Father – Inspector

Mesothelioma

Age 72 – Deceased – Plumber/Steamfitter

Mesothelioma

Age 63 – Deceased – Field Engineer

Mesothelioma

Age 60 – Deceased – Plumber

Mesothelioma

Don't Wait, Access Mesothelioma Settlement Funds Now

If you’ve been diagnosed with mesothelioma or another asbestos illness, you could recover substantial compensation through a mesothelioma trust fund, but time is limited. We have helped thousands of mesothelioma victims recover maximum compensation through asbestos trust funds, lawsuits, and other resources.

When you reach out to our law firm, we will go right to work to recover your compensation as soon as possible. We will come to you and do the legwork so you can collect your funds after we win your claim. Contact us today for a free consultation.

View Our List of Asbestos Trust Funds

Here is a full list of the asbestos bankruptcy trusts, along with information about who was exposed and the history of the company:

A & I Company Trust

A-Best Trust

A.P.I Asbestos Trust

ABB Lummus Trust

Armstrong World Industries Trust

Asarco, LLC Trust

Brauer Supply Trust

Burns & Roe Trust

C.E. Thurston Trust

Christy Refractories Trust

EJ Bartels Asbestos Settlement Trust

Ferodo Trust

Flexitallic Trust

Fuller Austin Insulation Inc Trust

General Motors Corporation

GI Holdings Trust

Halliburton Company Trust

Hercules Chemical Company Trust

J.T. Thorpe Settlement Trust

J.T. Thorpe Company

Kentile Floors, Inc.

Leslie Trust

North American Refractories Trust

Pacor Trust

Phillip Carey Manufacturing Trust

Plant Insulation Trust

Porter Hayden Trust

Rapid American

Raytech Trust

Shook & Fletcher Trust

T & N Limpet Trust

THAN – TH Agriculture and Nutrition Trust

Thorpe Insulation Company Trust

U.S. Mineral Products Company Trust

UGL Trust

Western Asbestos Trust

Worthington Pump and Machinery Trust

Yarway Bankruptcy Trust

Asbestos & Mesothelioma Fund Claims FAQs

Can a Family Member File an Asbestos Trust Fund Claim?

The surviving spouse or other qualified survivors may file an asbestos trust fund claim after someone has passed away from an asbestos-related illness. Family members can also continue a claim initiated before death.

If you are the family member of someone who carried asbestos fibers home from work on their clothing, and you have been diagnosed with mesothelioma, you may be able to file a secondary exposure trust fund claim.

How Long Do I Have To File an Asbestos Trust Fund Claim?

Every trust fund sets its own filing deadlines. These deadlines are typically based on the statute of limitations in the state where you file your claims. This is generally one to three years after your diagnosis, but it differs from state to state. An experienced mesothelioma lawyer can determine the deadlines that apply to your trust fund claim.

Can Multiple Sources Be Responsible for Asbestos Exposure?

Yes, multiple sources may be responsible for your asbestos exposure. In fact, this is the case more often than not. For example, if you were exposed through work, your employer may have ordered asbestos-containing products from multiple companies. All of them would be responsible for your asbestos exposure.

Can You Sue a Bankrupt Asbestos-Related Company?

Filing for bankruptcy is normally used as a strategy to shield the filing company from the full brunt of its liabilities. This is why the U.S. Bankruptcy Code requires companies with asbestos liabilities to establish trust funds. Asbestos and mesothelioma rust fund claims are the best way to recover compensation from asbestos companies that have filed for bankruptcy.

Should I File an Asbestos Trust Claim or Lawsuit?

The type of claim you can file will depend on whether the company responsible for your asbestos exposure is bankrupt. If the company is bankrupt, a trust fund claim is the best way to recover compensation. If the responsible company is solvent, you will likely need to file a lawsuit to recover compensation instead.

How Are Asbestos Trust Fund Payouts Calculated?

Asbestos trust fund calculations vary according to whether you file an expedited claim or an individualized claim. Generally, higher exposure levels result in higher payments, but the trust fund claims administrator will look at all factors, including your pain and suffering and the financial costs of your asbestos-related condition.

Are Asbestos Trust Fund Payouts Taxable?

Funds received as compensation for injuries are generally not taxable, but you should always check with your attorney to ensure you comply with all of the tax laws applicable to your claim.

Can You Pursue Compensation for Asbestosis and Other Asbestos-Related Diseases?

You can recover compensation for most asbestos-related illnesses. Asbestos-related diseases for which you can receive a trust fund payout include mesothelioma, lung cancer, asbestosis, pleural plaques, and other cancers.

Do I Need a Lawyer To File Asbestos Trust Claims?

The asbestos trust fund administrators allow people to file claims without an attorney, but this is not recommended. The funds have specific filing and evidentiary requirements. Our experienced asbestos attorneys can identify all of the claims you qualify for, gather the evidence for you, assess the type of claim you should file, and determine how much compensation you should demand.